The Tata Motors share price has seen considerable fluctuations over the past decade. These movements are often tied to multiple internal and external variables such as quarterly results, management decisions, acquisition strategies, and changing consumer demands. During phases of robust earnings and successful vehicle launches, especially in the EV and SUV segments, the share price has surged, attracting positive sentiment. Conversely, global slowdowns, regulatory challenges, or underwhelming financial reports have at times led to declines.

For example, in 2020, during the early months of the COVID-19 pandemic, the company’s stock took a sharp hit due to disrupted supply chains and declining vehicle demand. However, post-pandemic recovery, supported by aggressive EV plans and a renewed focus on financial discipline, helped the share price rebound significantly. Investors who took long positions during the downturn saw considerable gains over the next two years.

Key Factors Driving Tata Motors Share Price

There are several critical components that directly and indirectly influence the Tata Motors share price:

1. Financial Performance and Quarterly Results

Earnings reports remain one of the most important metrics affecting stock price. If Tata Motors reports strong revenue growth, higher profit margins, or improved debt ratios, investor confidence grows, typically leading to a rise in the share price. Conversely, weak financials, particularly consistent losses or increased debt burden, can lead to a dip.

2. Electric Vehicle (EV) Strategy

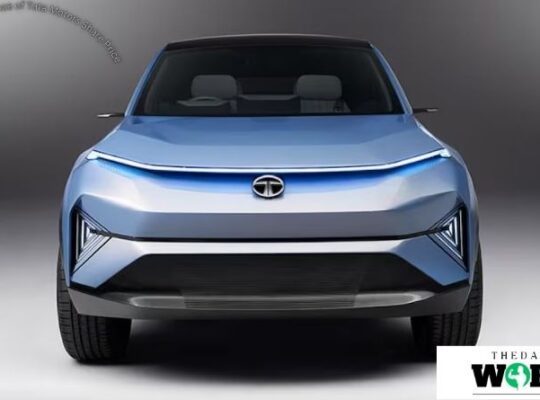

Tata Motors has taken significant steps in the electric vehicle space, launching models like the Tata Nexon EV and Tigor EV. The company’s commitment to sustainable mobility has been well received, especially at a time when EV demand is growing both in India and globally. Analysts and investors closely watch this segment for growth potential, and any announcement related to new EV models, partnerships, or battery technology developments often influences the share price positively.

3. Performance of Jaguar Land Rover (JLR)

Since acquiring Jaguar Land Rover, Tata Motors has gained a stronghold in the premium vehicle market. However, JLR’s performance—especially in China, Europe, and the U.S.—has a direct impact on the parent company’s financials. Any success or setback in JLR’s sales, innovation, or regulatory compliance significantly affects the Tata Motors share price.

4. Raw Material Costs and Supply Chain Challenges

The prices of key automotive raw materials such as steel, aluminum, rubber, and semiconductor chips play a vital role in determining production costs. A spike in these inputs can pressure margins, causing investor concerns. Additionally, supply chain disruptions, such as those seen globally due to chip shortages, often lead to production delays, which can negatively affect the share price.

5. Regulatory and Policy Environment

Government policies such as GST reforms, import-export duties, and subsidies for electric vehicles can have a direct effect on automobile demand. Tata Motors, being a large player, is particularly sensitive to these changes. A favorable policy environment generally leads to bullish behavior in the stock market regarding the company’s shares.

Recent Trends in Tata Motors Share Price (2024–2025)

In the fiscal year 2024–2025, the Tata Motors share price demonstrated a generally upward trajectory. Several contributing factors were at play, including:

- Robust domestic sales, particularly in passenger and electric vehicle categories.

- Recovery in Jaguar Land Rover sales after years of COVID-related slowdown.

- Announcements of future investments in EV infrastructure and manufacturing.

- Rising consumer sentiment and an overall bullish trend in Indian stock markets.

Moreover, the company’s successful cost-cutting measures and increased focus on innovation have bolstered investor confidence. By mid-2025, the share price had reached multi-year highs, prompting analysts to revise their target prices upward.

Investor Sentiment and Analyst Opinions

Market analysts typically provide “Buy,” “Hold,” or “Sell” recommendations based on detailed research. Over the past few quarters, many leading brokerage firms have maintained a “Buy” rating on Tata Motors, citing strong management, product pipeline, and robust EV adoption.

Investor sentiment, particularly among retail traders, has also been optimistic. Tata Motors is frequently listed among the most traded automotive stocks on Indian exchanges, including NSE and BSE. Retail and institutional investors both value the stock for its blend of traditional strengths and future-forward strategies.

Long-Term Growth Outlook

Looking ahead, Tata Motors’ growth story appears compelling. The company is well-positioned to benefit from the following factors:

- Expansion in the electric vehicle market, both domestically and internationally.

- Increased focus on digital transformation and smart mobility.

- Sustainability initiatives, including carbon neutrality targets.

- Emerging market penetration, where car ownership is rising.

However, risks such as geopolitical instability, global economic downturns, or renewed supply chain issues could impact this trajectory. Investors must stay informed and be cautious of overvaluation risks, especially when the stock experiences rapid run-ups.

Comparison with Peers

Tata Motors competes with several domestic and international automotive players, including Mahindra & Mahindra, Maruti Suzuki, Hyundai, and global giants like Toyota and Ford. While companies like Maruti Suzuki dominate in terms of market share in compact cars, Tata Motors has carved a niche in the SUV and EV segments.

Among peers, Tata Motors stands out for its aggressive EV roadmap, making it a favorite among sustainability-focused investors. It also scores high on innovation, thanks to its connected car technologies and emphasis on digital user experience.

Tips for Investors Monitoring Tata Motors Share Price

- Track Quarterly Earnings Reports: These offer insights into revenue growth, operational performance, and strategic direction.

- Watch EV and JLR News: Developments in these areas have high share price impact.

- Follow Government Announcements: Especially around automotive policies, subsidies, and emissions regulations.

- Use Technical Analysis: Identify support and resistance levels, RSI indicators, and moving averages to make informed entry and exit decisions.

- Stay Updated on Global Trends: Tata Motors’ global exposure means foreign market conditions also matter.

Conclusion: Should You Consider Tata Motors for Your Portfolio?

The Tata Motors share price has shown resilience and potential for long-term growth, driven by strong fundamentals, a forward-looking approach, and alignment with global trends in sustainability and mobility. While short-term fluctuations are inevitable due to broader market dynamics, the company’s consistent efforts in innovation, cost-efficiency, and global expansion offer promising prospects for investors.

However, like with all stock market investments, due diligence, diversification, and periodic review are crucial. Whether you’re a seasoned investor or a new entrant, keeping an eye on Tata Motors could be a strategic move, especially as India accelerates toward becoming a global automotive powerhouse.

May Also Read: thedailyworld