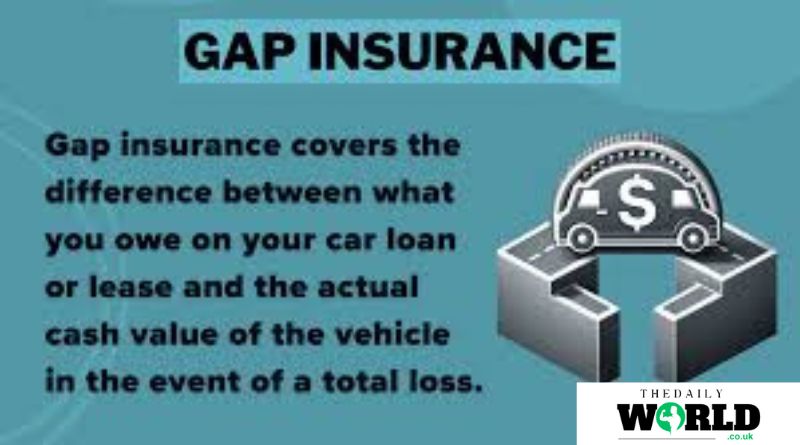

Gap insurance, also known as Guaranteed Asset Protection insurance, has become an essential safeguard for car owners who owe more on their vehicle than its current market value. As new car prices and auto loan terms increase, so does the need for gap insurance, especially in 2024. Stand-alone gap insurance is a separate policy purchased independently of your auto insurance, giving you flexibility in choosing a provider and coverage that best suits your needs. If you are considering stand-alone gap insurance in 2024, this article will guide you on where to find it, how it works, and why you might need it.

What Is Stand-Alone Gap Insurance?

Stand-alone gap insurance is a policy that covers the “gap” between what your car is worth at the time of an accident and what you still owe on your loan or lease. This type of insurance is particularly helpful for those who have a high loan-to-value ratio on their vehicle. For instance, if you have a long-term loan or little to no down payment when purchasing the car, you could easily find yourself in a situation where the car depreciates faster than you can pay off the loan.

Many car owners assume their regular auto insurance policy will cover the remaining amount owed on their car loan if the vehicle is totaled. Unfortunately, auto insurance only pays out the car’s current market value, which can leave you with thousands of dollars in unpaid debt. Stand-alone gap insurance steps in to cover that gap, ensuring you are not left financially vulnerable.

Why You Need Stand-Alone Gap Insurance In 2024

In 2024, rising vehicle costs, increasing loan amounts, and longer loan terms have made gap insurance more important than ever. Car prices have soared due to inflation and supply chain disruptions, leading to higher loan amounts. Coupled with the rapid depreciation that occurs once you drive a new car off the lot, you could easily find yourself owing more than your car is worth.

If your vehicle is stolen or totaled in an accident, your regular insurance will only cover the market value of the car at the time of the incident. This means that if you have a $30,000 loan on a car that is now only worth $20,000, your insurance will pay $20,000, leaving you to cover the remaining $10,000. Without gap insurance, you would be left paying out of pocket for a car you no longer have.

Gap insurance also becomes essential when leasing a vehicle. Many lease agreements already include gap insurance, but if it’s not included, purchasing a stand-alone policy ensures that you are protected in the event of an accident or theft. In some cases, even if gap insurance is included in your lease, you may find that stand-alone gap insurance offers better coverage at a lower cost.

Where To Find Stand-Alone Gap Insurance In 2024

Finding stand-alone gap insurance in 2024 is relatively easy, as many providers now offer it either as a separate policy or as an add-on to your current coverage. Below are some of the most reliable sources for purchasing stand-alone gap insurance.

- Online Insurance Providers

Online insurers are becoming increasingly popular for those seeking flexible and affordable insurance solutions. Companies like Progressive, GEICO, and Nationwide offer gap insurance that can be purchased independently of an auto insurance policy. These online providers allow you to compare quotes and coverage options easily, ensuring you get the best deal.

When shopping for stand-alone gap insurance online, it’s essential to read the policy details carefully to understand what is and isn’t covered. Some providers may offer full gap coverage, while others may only offer partial coverage or limit their policies to new vehicles. Ensure that the policy covers the full difference between the loan amount and the vehicle’s value, and check for any exclusions.

- Banks and Credit Unions

Many banks and credit unions offer gap insurance as part of their loan or lease agreements. When taking out a car loan, ask your lender if they provide stand-alone gap insurance. In most cases, this insurance is offered as an add-on at the time you sign the loan documents, but it can also be purchased later.

The benefit of getting gap insurance through your lender is convenience. You can roll the cost into your loan, making it easy to manage payments. However, the downside is that lender-provided gap insurance is often more expensive than policies purchased independently.

- Dealerships

Car dealerships frequently offer gap insurance as part of the vehicle purchase process. While this can be a convenient option, dealership gap insurance is typically more expensive than policies purchased from an insurance company or online provider. If you choose to buy gap insurance from a dealership, make sure to compare it with other options to ensure you’re getting the best coverage at a reasonable price.

Additionally, it’s important to note that dealership gap insurance may not cover the full loan amount. Read the fine print to make sure that the policy will pay off the remaining balance on your loan, not just a portion of it.

- Independent Insurance Agents

Another option for finding stand-alone gap insurance in 2024 is through an independent insurance agent. Agents work with multiple insurance companies and can help you find the best gap insurance policy for your needs. They can provide you with multiple quotes, explain the terms of each policy, and help you select the coverage that best fits your financial situation.

Working with an independent agent can be especially helpful if you have a unique financial situation, such as a long-term loan or a car with significant depreciation. Agents have access to a wider range of policies than you would find online or through a lender, allowing you to customize your coverage.

Factors To Consider When Buying Stand-Alone Gap Insurance

When purchasing stand-alone gap insurance in 2024, it’s essential to consider a few critical factors to ensure you get the best coverage:

- Coverage Limits

Ensure the gap insurance policy covers the entire difference between your car’s value and the loan amount. Some policies may have limits or exclusions that leave you with unpaid debt.

- Premium Costs

Compare premium costs across multiple providers. While gap insurance is generally affordable, rates can vary significantly depending on the provider and the level of coverage.

- Policy Duration

Determine how long you will need gap insurance. In most cases, you only need gap insurance for the first few years of owning a new car. Once the loan amount drops below the car’s market value, gap insurance is no longer necessary.

- Claim Process

Understand the claim process for each provider. Some insurers may require additional documentation or have a more complex claims process, so make sure you know how to file a claim in the event of an accident.

Conclusion

In 2024, finding stand-alone gap insurance is more important than ever due to rising car prices, longer loan terms, and increasing vehicle depreciation. By purchasing a stand-alone policy, you can ensure that you are fully protected in the event of an accident or theft. Whether you choose to buy gap insurance online, through a lender, at a dealership, or with the help of an independent agent, make sure to compare policies carefully to find the best coverage for your needs. With proper gap insurance, you can drive with peace of mind, knowing you’re protected from financial loss in the event of a total loss or theft.

Read also: check